Digital payment solution firm Apptivate Africa has signed agreements with KFC, Big Square and NewsCafe that will see customers use the company’s flagship app M-Kula to pay for their meals.

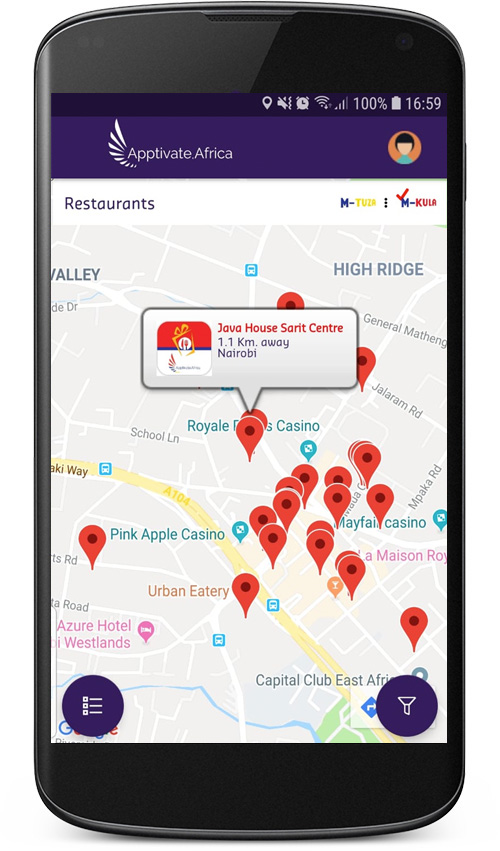

M-Kula; which is available on IOS and Android platforms allows employers e-wallets of their employees with money that can be used for meals. The employees conveniently use the e-wallet to settle food bills in partner eateries.

Speaking on the partnership, Apptivate Africa CEO Neil Ribeiro said “The app will not only bring payment convenience at KFC Big Square NewsCafe but also give end users 60 more outlets countrywide to use their M-Kula Wallets.”

He added that the app brings monetary safety to both food lovers and eating joints since transactions are cashless. ‘’M-Kula saves time, and there is no need for customers to wait for change,’’ he said.

Kuku Foods east Africa Chief Operations Officer Jacques Theunissen said KFC is pleased to sign up with M-Kula to ease convenience in customer services.

‘’We continue to offer consumers more opportunities to choose us, by partnering with strategic partners like M-Kula. With our growth in footprint, consumers have access to the brand in multiple locations in the country,’’ Theurinissen said.

Launched in 2016, M-Kula has so far partnered with over 300 eating joints in Kenya and is expected to spread to other countries in the continent including Uganda, Rwanda and Malawi.

M-Kula’s parent firm Apptivate Africa has been at the forefront in championing for a lunch programme for employees in Kenya, thanks to the Finance Act 2014 that exempted from taxation food offered to employees for up to Sh48, 000 every year, the equivalent of Sh4, 000 a month.

According to employers already using M-Kula, affordable lunch packages will help employers’ improve staff productivity, retention and companies’ profitability.

To bolster the reach and convenience, the has partnered with over 300 food outlets including Vibandas, Dial and deliver services like, Jumia Food, Java, Debonairs, Nyama Mama among others.

To start, and employer has to log into a portal, enter their employee details and amounts and fund the wallets via bank transfer or mobile money.

“Technology offers companies one of the cheapest and innovative ways that balances between staff’s well-being and the company’s profitability.