An anonymous party has opposed the proposed transfer of assets worth 2 billion shillings held by one of SportPesa’s companies to the UK government.

Liverpool-based SPS Sportsoft Limited, which offers gambling software and support services, on Tuesday published a notice of its dissolution which will result in surrendering all its assets to the government.

The company, which has common shareholders with its parent firm Sportpesa Global Holdings Limited (SPGHL) and Kenya’s pioneer sports betting firm Pevans East Africa Limited, now says it has received an objection to its dissolution.

“Action under Section 1000 of the Companies Act 2006 has been temporarily suspended as an objection to the striking off has been received by the Registrar,” the company said in a notice yesterday.

SPS did not name the party objecting to the dissolution and neither did it say why it is being liquidated.

The law says that a UK company can be dissolved by its creditors or if it fails to comply with its legal obligations.

The move to wind up SPS comes after its biggest client, Kenya-based Pevans, ceased operations in 2019 after the government declined to renew its operating licence citing billions of shillings in unpaid taxes.

Pevans paid the Liverpool-based multinational £20.6 million (Sh3.1 billion) in the nine months ended December 2018, accounting for 96 percent of the total revenue of £21.6 million (Sh3.2 billion) in the period.

SPS clients include SPGHL’s subsidiaries trading under the SportPesa brand in Tanzania and South Africa.

SPS ended the period with total assets of £13.2 million (Sh2 billion) that will be surrendered to the UK government.

“Property, cash and any other assets owned by a company when it is dissolved automatically pass to the Crown. This is because the law says this happens,” the UK government says on the process of taking over ownerless property technically known as bona vacantia.

“Liabilities of a company do not pass to the Crown on dissolution: they are normally extinguished.”

SPS’s creditors risk losing a combined £8.5 million (Sh1.2 billion) that they were owed in the review period.

The company was required to publish its 2019 accounts by December last year but breached the deadline and could now be liquidated without releasing its updated financial statements.

Its dissolution marks another loss for its shareholders, including Kenyan entrepreneurs Paul Ndung’u and Asenath Maina who fell out with their Bulgarian counterparts over control and management of the SportPesa entities.

Pevans’ operating licence was cancelled in July 2019 over unpaid taxes and penalties that the Kenya Revenue Authority (KRA) now says stand at Sh95 billion.

The company last reported revenues of nearly Sh150 billion in 2018 in what made it the second-largest firm by revenue in Kenya after Safaricom.

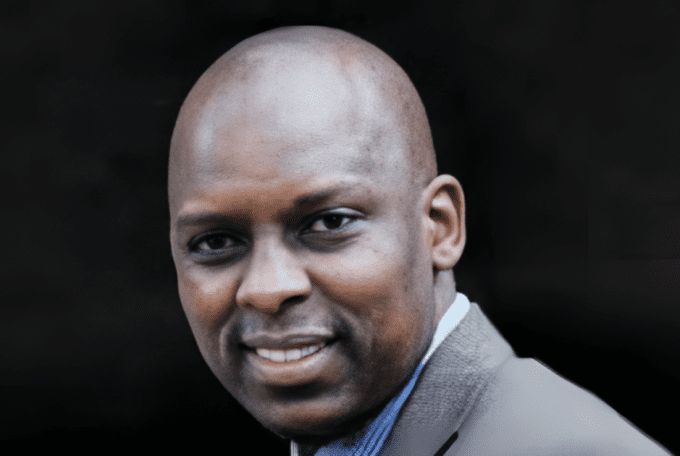

The Bulgarian investors and Ronald Karauri, a Kenyan who is Pevans’ chief executive and also a shareholder in the SportPesa entities, later re-entered the local gaming business in October last year under a new company called Milestone Games Limited to which they transferred the SportPesa trade name.

The valuable SportPesa brand was transferred from Pevans to SPGHL for £100,000 (Sh15.1 million) and then to Milestone in transactions that started on June 2, 2020.

Source: Business Daily